Financial API is a topic that has been growing popular in recent years. If you have the habit of looking into charts about recent stock prices, or anything finance-related, you might have wondered how developers get access to these data. In today’s article, we will discuss how you can leverage financial API to your advantage by building robust financial tools and services as a developer.

API

API, or Application Programming Interface, is software that lets two applications communicate with each other through the internet.

Say, there is a weather database with all the necessary data about the weather, temperature, humidity, and so on. Your phone sends data to the server through the internet. The server then collects the data, interprets it, and sends it back to your phone. Now your phone has the necessary data, right from the database, and it can now present it in a readable manner. During all these actions, neither the phone nor the server had to expose any confidential information to each other, ensuring security.

It doesn’t always have to be a weather API, it could be a currency API, to build an app based on converting currencies based on their real-time value. Anytime you build software that retrieves data from an external source, you are most likely using an API.

This technology is being increasingly used among mobile developers to flawlessly collect and present data from the internet on their software. To make all this better, there have been recent changes in the way we use API (RESTful API), making it more sophisticated and easy to implement for the developers. All these improvements are constantly shaping the software development arena, making it a sensible approach to building financial tools and services.

FINANCIAL APIs

Financial APIs, in simple terms, are APIs that carry financial data. This usually involves data like market data, stock prices, and forex rates offered in real-time. These data are now used by companies like Robinhood and Square, through financial API, to provide their services. Once again, all this is done, with neither of the entities directly interacting with each other. Now these data can be essential depending on the kind of service you would want to provide in your app or software.

Say your app revolves around working on the forex rates. Here, using financial API reduces a chunk of time in collecting the data, and using it to your advantage in your software. In addition to that, all the real-time data is provided to you from the financial data providers without compromising your digital security.

Now that we know exactly what we are looking at, let’s explore some of the most widely used Financial APIs that can help you get started to build your brand-new financial service app.

TOP FINANCIAL API

Now depending on the kind of data you might want to acquire, there are various financial API providers you can go with. Here, we will discuss some of the types of financial APIs and the kinds of data they provide to help you decide the type you would want to go for.

1. Market Data APIs

One of the most common APIs in use, the stock market API is exactly what the name suggests. The data from these APIs involve current, or past prices of stocks of financial assets and companies. Say you want to retrieve the share price of Company A on the NASDAQ from the year 2020 to the present day. This is exactly the type of financial API you should look for if this is your case.

Top Market Data APIs:

- Alpha Vantage: https://www.alphavantage.co/

- IEX Cloud: https://iexcloud.io/

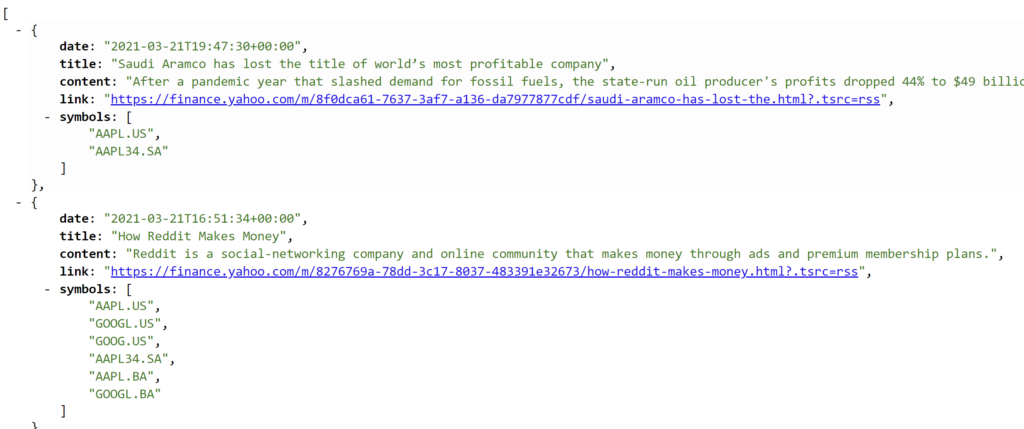

2. Financial News APIs

As depicted in the picture above, these APIs provide you with data related to financial news. Say you own a website that displays certain data that involves day-to-day financial content, using a financial news API should help you implement it.

Top Financial News APIs:

- News API: https://newsapi.org/

- Bing News Search API: https://www.microsoft.com/en-us/bing/apis/bing-search-api-v7

3. Cryptocurrency APIs

These APIs provide you with real-time cryptocurrency prices, like Bitcoin and Ethereum. Any app that revolves around cryptocurrency charts and prices, uses this type of API.

Top Cryptocurrency APIs:

- CoinGecko: https://www.coingecko.com/en/api

- CoinCap: https://coincap.io/

4. Payment APIs

Payment apps like Paypal and Apple Pay use payment APIs to help provide the service.

Top Payment APIs:

There are other types of Financial APIs, like

- Banking APIs

- Risk Management APIs

- Credit Scoring APIs

- Trading APIs

- Fraud Detection APIs

Once you have an idea of the kinds of API you can potentially use to build whatever service you want to

FINANCIAL API AS A DEVELOPER

Today, the usage of these data by developers is growing common. Financial APIs provide a way for developers to come up with data-driven solutions and market insights in the most sophisticated way. In this section, we will see how Financial API can benefit you as a developer.

Data like currency exchange rates, and stock prices are necessary to come up with finance market solutions. Through Financial APIs, you as developers have this information at your fingertips. With the right knowledge about financing you can seamlessly build tools that were once reserved only for large financial institutions.

Not only that, through payment APIs, you can now implement secure payment methods into your app. Through these payment APIs, developers can help provide users with a new experience of interacting with managing funds and handling smooth transactions within the app. There’s this endless list of solutions you can create just by taking advantage of this robust technology.

In essence, you will require this data to build financial apps in the best way possible. Alright, enough of theory. Now that you know how this API can help build your solution apps, let’s move on to the next section that’s going to be more practical.

HOW TO USE FINANCIAL API

In this section, we learn how to implement financial API in your app. In case you already know what you want to build, but don’t know where to start, you might want to follow the steps we mention here. If you are just looking to understand the work, we will walk you through the process.

If you are not sure about the kind of API you want to use in your app, get back to this section.

Step 1: Pick an API

Once you have decided on the kind of API you want to use, you can pick one of the top API providers we have mentioned in the same section.

Step 2: Getting the Access

Once you get into the website, you’ll either find a “sign up” option or “Getting started” instructions. Once you are done with it, the website will provide you with an authentication key to access the API.

Step 3: Authentication

This is the step where you will use the authentication key to get access to the API. Having the authentication key means that you are allowed to access the API. Sometimes getting your hands on the authentication key might come with a fee. Once you have the authentication key, you’ll find how to use it in the documentation

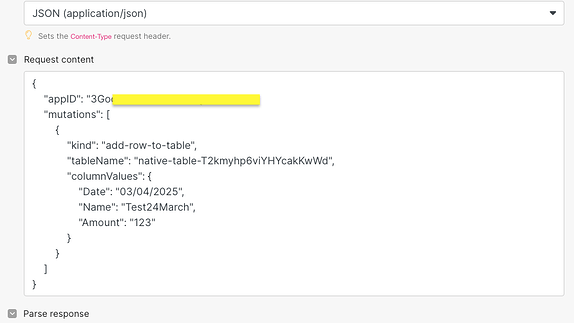

Step 4: Making API Requests

Here, you will use HTTP requests (GET, in this case) to make requests to the API. This can vary depending on the language and framework you are using to build the app, but the concept is still the same. Once you make the HTTP GET request, you will be able to get hold of the data. Sometimes the requests might require parameters like “time”, or “stock quotes”, but the instructions for it would be mentioned in the documentation.

POTENTIAL PRODUCTS USING FINANCIAL API

Just like any other API, financial API provides you with the opportunity to build several kinds of finance solution software. You can either try to implement the ones we are about to mention or get some inspiration to build your brand-new finance product.

Here are 5 potential products you can build through financial API are

1. Personal Finance Tracker

Not just any finance tracker where you are expected to enter income and spending manually, but using financial API to fetch the transactions automatically as they happen and put them in categories (like Groceries, Travel, and Entertainment). Traditional Budget apps with manual input are a thing of the past, nowadays plenty of budget apps use this technology to provide a rich user experience. For developers, this is a very beginner-friendly option to go with, and it doesn’t take a lot of time to implement.

2. Investment Portfolio Manager

This is especially helpful for users with investments in multiple financial instruments, say, stocks, bonds, mutual funds, and so on. This app can help summarize and help the users manage and optimize their investments under one single interface. The development of this app can be a little tricky but can be an exquisite finance tool for investors.

3. Professional Invoice Generator

Financial API can be used in this case for currency conversions and payment processing. You can build this app to be used by small business owners to generate professional invoices.

4. Cryptocurrency Tracker

You can build a cryptocurrency tracker that fetches the values in real-time and displays them on the app. You can build this app to keep track of market trends and prices and visualize them on a stunning user interface. This is a project that is pretty easy to build. It’s not the best idea, nonetheless, it’s a great project for beginners that involves financial API. There are loads and loads of apps on the market that do the same thing, although you can consider building it if you have interesting insights.

5. Stock Market News App

Through “Financial News API” we discussed 2 sections ago, you can gather real-time news about the Stock market and trends. This data from various sources can then be used by you on your news website.

These are not the only kinds of products you can build using financial API, your imagination is the limit. It can be for personal finance management, a money-making product, or just a project you want to build, in any case, there are plenty of ways you can take advantage of the technology.

CONCLUSION

Well done, we just looked into one of the most trending technologies used in the software development field to build finance tools. Financial APIs are not only popular these days, but the developments in API technology as a whole are never-ending. Traditional APIs are now replaced by RESTful APIs to improve scalability and flexibility in development. Moreover, these advancements are now letting developers experience new depths of using API without needing to worry about complexity.

Financial tools were once linked only to large finance industries. With APIs, technology has so far that what was once available only to finance giants can now be built in your home with a few lines of code. We have given you a brief introduction about what and how you can build one. Now, it’s up to you to use it to your maximum advantage to the best out of it. Check out our Finance blogs for more such posts!

5 legit ways to make money online

Woah! I’m really enjoying the template/theme of this site. It’s simple, yet effective. A lot of times it’s very hard to get that “perfect balance” between usability and visual appearance. I must say you have done a great job with this. Additionally, the blog loads very fast for me on Safari. Exceptional Blog!

Great!!! Thank you for sharing this details. If you need some information about Car Purchase than have a look here QH3

Your blog has really piqued my interest on this topic. Feel free to drop by my website UQ8 about Advertising.

If you are looking for jobs from home then click me to see details

if you wish to make money online from home with using your mobile you just need one telegram account and internet connection. simply click and see whats secret.

This is very insightful.

Just Click And Give Correct Answer To Get Your Free Gift Card

If you click you will be surprised!

This is top-notch! I wonder how much effort and time you have spent to come up with these informative posts. Should you be interested in generating more ideas about Airport Transfer, take a look at my website QU9

Following Stripe’s rules shows that you’re a trustworthy business owner.

Live in the USA and want to work from home? Join Trusted USA Jobs today and start earning with a trusted company. Secure your spot now!

Secure a trusted payment gateway for high risk merchants with this service.

Secure a reliable payment gateway for high risk merchants with this trusted provider.

Are you planning to buy a Stripe account verified for your business needs? Look no further. Purchasing a verified Stripe account from a reputable source can save you significant time and effort. Verified Stripe accounts are essential for businesses that require a robust and reliable payment processing system. They ensure that you meet all compliance requirements and can start accepting payments without any delays. When you buy a Stripe account verified by professionals, you gain access to a seamless and secure payment gateway, allowing you to focus on growing your business. This provider offers fully verified Stripe accounts, ensuring your transactions are handled with the utmost security and efficiency.

Aged Stripe accounts for better transaction history.

Trustworthy high-risk payment processors streamline financial transactions seamlessly.

Yesterday, while I was at work, my sister stole my apple ipad and tested to see if it can survive a 40 foot drop, just so she can be a youtube sensation. My iPad is now broken and she has 83 views. I know this is completely off topic but I had to share it with someone!

You made certain fine points there. I did a search on the issue and found mainly persons will consent with your blog.

Buy Drugs