For those of you who are new to stocks and investing, you might be wondering how experienced investors know when to buy and sell their stocks, and where and how to invest in order to make the maximum profit. With all the available data, investors use this as an opportunity to analyze and come up with financial decisions that are best suited for them. There are many ways to do this, and many tools to help you perform postmortems on the stock price data like a pro. In today’s post, we will look into what stock analysis is and what you can do to get better at it.

1. STOCK ANALYSIS

Stock analysis or market analysis involves studying the charts, you look at the charts find patterns and insights that will help you decide what you must do. It’s where the investor or trader investigates the stock prices of a certain company or trading instrument. This involves looking at the past and present prices of the stocks to come to a conclusion.

Right now, the numbers might not mean alot to in predicting how the company, or the whole market in general, would do in the future. But to an experienced investor who knows how to handle these numbers, this data would serve as a great help in gaining an edge in the market with informed decisions.

While performing stock analysis, investors tend to look at similar companies and see how they perform during a certain period of time under certain conditions. These patterns can tell alot of about the particular company’s stock prices might react to the current economic conditions. Once again, boiling down to using historical instances in order to guess what could happen.

Sometimes, investors can also use stock analysis as a way to find an entry into the market, or make an exit with a decent profit. Overall, the purpose of stock analysis is to help us get an idea how the market might perform in the future, and make our moves with all that in the mind.

In the next section, we will look at different types of analysis that are usually performed by stock analysist. Along with that, we will also look at some good practices that stocks analysts usually use when investigating the market.

2. WHAT DO STOCK ANALYSTS DO

Now that you know what stock analysis is, let’s get a view of a few methods stock analysts use to gain insights from stock prices. There are many ways to do this, and in this section, we will be looking at three of them.

- Fundamental Analysis

- Comparative Analysis

- Technical Analysis

2.1. Fundamental Analysis

Fundamental Analysis involves analyzing the business from basic financial records. Here, we focus on data from sources that are available to the public to evaluate if the prices reflect the company’s performance in the future.

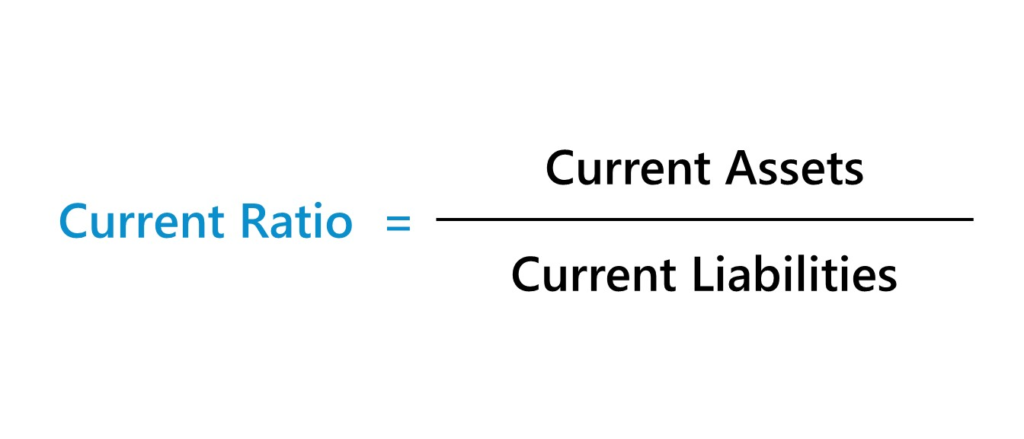

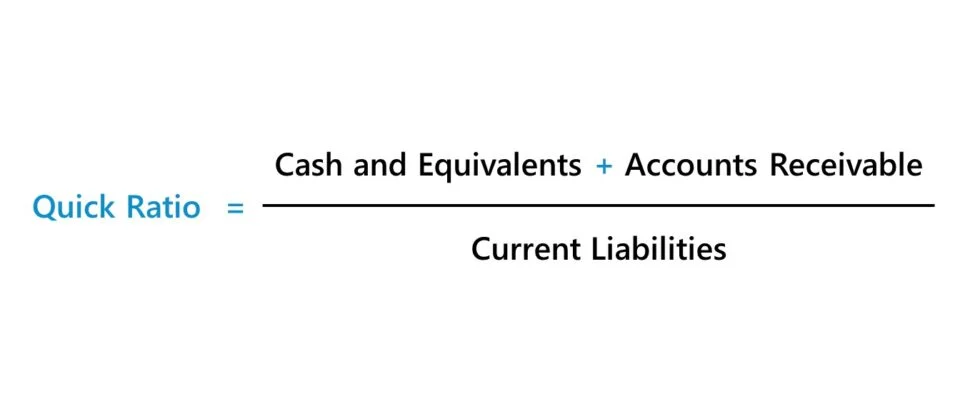

Typically this is done by checking if the company can pay up its short-term obligations along with being able to do well in the current market. Analysts also take a look at the company’s short-term liabilities and short-term assets to get a general sense of what could be expected. This is usually done by calculating the current ratios and quick ratios.

These ratios don’t determine whether the prices will go up or down in the future. But if the value of the ratio is less than 1, it’s possible that the company isn’t doing well financially. Meaning the company might have a hard time fulfilling its financial obligations in the short-term. On the other hand, if the ratios turn out to be greater than 1, this would mean that the company’s current assets is greater than its current liabilities. Meaning, that covering short-term obligations is doable, and the company is doing well financially.

These ratios give you an idea about the company’s financial position, therefore being able to tell whether or not it is gonna do well in the market.

2.2. Comparative Analysis

Comparative Analysis comes under fundamental analysis since it involves looking at the company’s data available to the public, to reach certain conclusions and get an overall idea about what to expect.

In a comparative analysis, we try to analyze the company’s performance compared to its previous years. This gives us a sense of the company’s growth since the previous years, so to speak. From this, we get to know if the performance has been going down, up or stayed the same throughout the year.

Comparative analysis need not be bound to comparing the company’s performance with the previous years. Another way is to compare the company’s prices with another similar company from the same domain. This way an analyst can determine how the company performs within the industry among several other competitors in the same industry.

This comparison needn’t be fettered to the stock prices. A stock analyst might look at several other aspects of a company when making the comparison. This can go from comparing the company’s profits, operational costs, liquidity ratios, and so on. Overall it comes down to a comparison of performances between the two organizations.

2.3. Technical Analysis

Finally, the technical Analysis, in this type of analysis, you try to gain insights and make predictions about the stock performance solely based on studying the prices in the past and present. In technical analysis, the analyst is only worried about the price, demand, volume, and supply factors that directly affect the chart.

Unlike in fundamental and comparative analysis, here only the graph matters, you make your predictions solely based on how the chart moves. Here you mark the origins (the previous highs and previous lows) that resulted in the upward or downward trend in the movement of the stock prices. By finding structures within the chart, an analyst can determine the performance of the prices in the future. These support levels, or origins help us get an idea about the trend that can be expected. A break above the origin indicates a bullish trend, and a break below the origin indicates a bearish trend.

3. SKILLS YOU NEED

No matter what your goal is in investing, in order to be a stock analyst, you must start thinking like one. Stock analysts tend to research selected industries and sectors. They look into the financial statements of the companies, getting the exact idea about the company’s current status. Looking at charts with all the prices, candle structures and tickers, they come up with the most creative insights that allow them to decide exactly when the sell and when to buy. There are a few skills that you might really need in your inventory to kickstart your financial journey.

3.1. Strong Knowledge Foundation

Before you do anything, you need to theoretically understand what’s going on here. Having a good financial knowledge foundation would be necessary in the long run. This is because when you start analyzing the stocks, you will come across plenty of terms and concepts that you would need to grasp to understand a company’s financial health.

This strong knowledge foundation would help you in the long run to assess the stocks you invest in. And it goes without saying, this whole thing revolves around financial concepts, therefore having a good understanding always gives you an advantage.

There’s plenty of online tools that can help you acquire this knowledge. Personally, I would recommend Investopedia, but as long as you find a course that fits your needs in learning all this, it should be good.

3.2. Learn To Be More Analytical

As mentioned earlier, to be a good stock analyst you need to start thinking like one. When you research on a specific company, try gathering as many insights as possible. Keep digging deeper, analyzing the overall company’s landscape, status, and team.

Additionally, it’s good to learn to read and understand financial statements from companies. You need to be able to come to certain conclusions based on the insights you gather from the statement. At one point, you will start treating information sources like company websites, industry news, and numbers like goldmines.

You can start by analyzing specific company charts, and try coming to conclusions by using either fundamental or technical analysis. Try using websites like Trading View, for better user experience. Try Actively utilizing all the charting tools available to aid your analysis.

3.3. Be A Good Gambler

Making the right decisions based on your analysis as a stock analyst is crucial. You need to know if you are going to be okay in taking high risk decisions if it meant high reward. It is true you can’t take decisions that can be 100% accurate, there’s always a risk. But as long as you realize the risk and make your move accordingly, you will be safe in the long run.

One good rule of thumb among gamblers in casinos is to never take a decision that can get you kicked out of the game forever. Smart gamblers realize the odds of things going south for them. You will never see a smart bettor taking up a gamble where losing would mean he can never play the game again. No matter how tempting the reward of winning can be, never do something that would cost you something more than you can endure. Stock analysts utilize risk management skills to navigate the uncertainties of the market.

In the book Psychology of Money, Morgan Housel states that balancing risk-taking and optimism is important to achieve financial success. And it’s true, you need to know how much risk you can endure, while not hesitating to take the risk at the same time.

4. WHAT SHOULD YOU ANALYZE

Stock analysis is basically knowing what to analyze and diving deep into a pool of information to make your assessments. In this section, we will be discussing the kinds of information you should look for when it comes to analyzing the stock prices and making a prediction based of the data you gather, during your time researching.

4.1. Financial Statements

As discussed in the previous sections, financial statements can be a great source for informations about a company’s financial health. When you start analyzing companies to predict stock prices, you will come across data containing income statements with all the numbers about the company’s income, expenses and debt.

As an analyst, it would be your job to judge if the company is growing consistenly, or rapidly, or if the overall performance is stable, or if its deteriorating. In essence, income statements and balance sheets are one of the main datasets you will need to gain insights from.

4.2. Industry Trends

When ever you try to research on a company, it’s always good to take a look at the industry. Companies that come under growing industries, tend to grow. When you see a decline in the industry’s growth, it’s most likely that the company’s prices would collapse sooner or later. If your investment plan is long term, try to look into industries that would most likely flourish in the coming years.

When you keep yourself updated with the trends in the market and the particular industry, you will know what to expect. Additionally, keeping yourself updated about the economic and regulatory factors that can affect the company or the industry’s performance is one other thing worth spending your time researching on.

5. TOOLS YOU NEED

Playing in the stock market is all about gathering knowledge and using analytical thinking to come up with right decisions. During this journey as a beginner, you might need a few tools that can come in handy, and in this section we will be listing out exactly that.

- Learning: Investopedia and Khan Academy

- Company Statements: SEC.gov EDGAR Database

- Financial News Outlets: The Wall Street Journal

- Analysis Platform: Trading View

As mentioned in the previous sections, start by working on your financial knowledge and then work your way up. To sum up, you must get your hands dirty with financial terms and concepts, along with learning to collect and use data to your advantage in making wise decisions in your investments, in other words, becoming your own stock analyst! Keep yourself updated with our posts about investing by clicking here.

obviously like your web-site however you need to test the spelling on quite a few of your posts. Several of them are rife with spelling issues and I in finding it very bothersome to inform the truth nevertheless I will certainly come back again.

Hey there! Thanks for the comment, I’m sorry for the poor spellings. I will definitely work on it and provide better quality content in the coming articles.

You made some really good points on your post. Definitely worth bookmarking for revisiting